Goods Services Tax GST Go to next level. Jabatan Kastam Diraja Malaysia Appendix 2 - Guide to enhance your accounting software to be GST Compliant Draft as at 13 March 2014 TX.

An Introduction To Malaysian Gst Asean Business News

GST Tax Codes for Supplies.

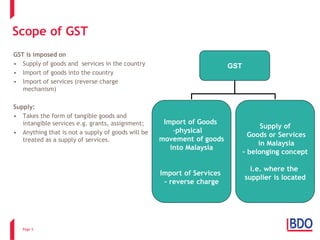

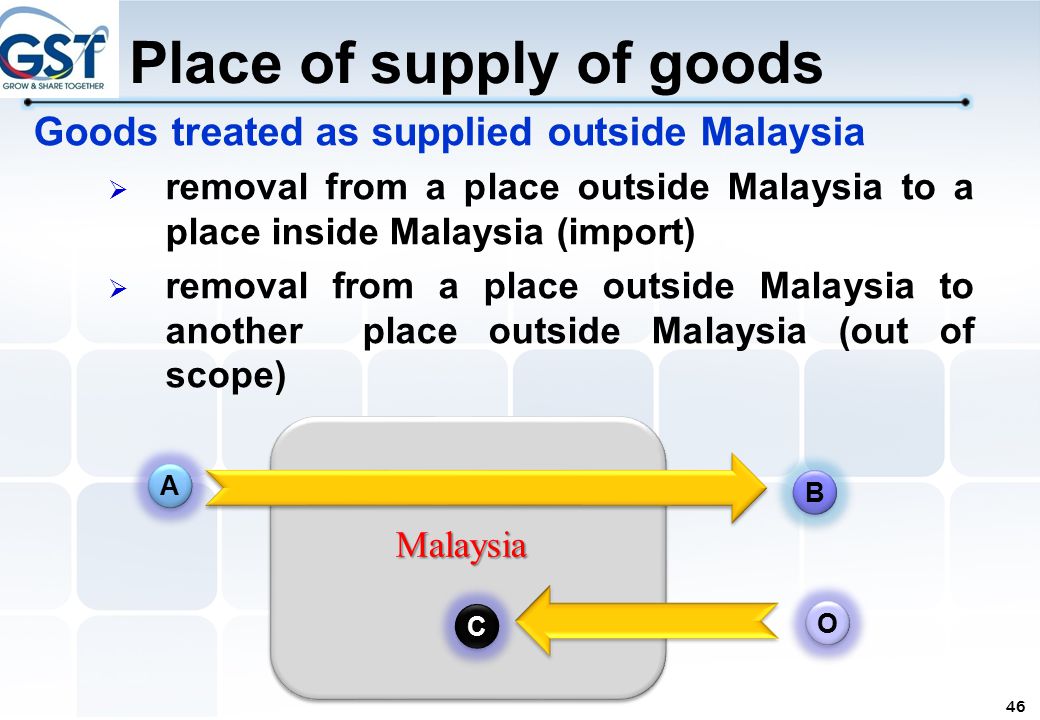

. Exempt and out of scope supplies are not taxable supplies. The Scope Change. Supplies not made in Malaysia are considered to be outside the scope of GST.

This section will explain to you about requirements with regard to registration for GST. For those that fall below this prescribed threshold it will me voluntary registration whereas those that exceed this amount it is a mandatory registration. All businesses will fall within the scope of GST unless they are specifically defined as zero-rated exempt or out-of-scope.

GST should be accountable at standard rate 6 on the value of supply up to 31 May 2018. O Prioritising close-out of GST issues eg clarifications notifications outstanding refunds. Not only broadened the scope of the tax system and brought in revenues of RM44 billion USD7 billion it has to be also.

Supplies made by the Government are generally treated as out of scope supplies. GST in Malaysia will be implemented on 1 April 2015 as announced by the Prime Minister cum Minister of Finance during the 2014 Budget. GST is to be charged on a taxable supply of goods or services where the supply is made in Malaysia.

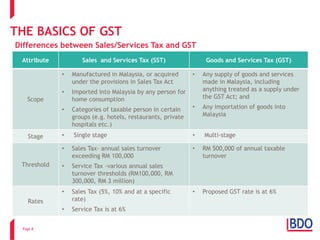

These are standard-rated supplies exempt supplies zero-rated supplies and supplies that are beyond the scope of Goods Services Tax. With a target to close all GST audit-related activity by the end of 2019 its unlikely that all 480000 GST registrants will be audited. The existing standard rate for GST effective from 1 April 2015 is 6.

Where an invoice is received after 01 June 2018 for services rendered prior to 01. These taxes can be levied and charged only if the business is registered under GST. In Malaysia GST largely falls under 4 different categories.

E-Learning Videos on GST. Out of scope purchases. Goods services that fall under each of these categories are pre-determined by the RCDM Royal Custom Department of Malaysia.

Sale of Goods not Brought into Singapore. Out of Scope GST Rate Claimable 6 0 --GST MECHANISM CONTD HOW GST WORKS. Goods Services Tax GST Basics of GST Go to next level.

The much sought after details and scope of the Goods and Services Tax GST have been released by the Custom Department. Download form and document related to RMCD. STANDARD RATED 6 28 Manufacturer Wholesaler 6 6 6.

The current sales tax and service tax will be abolished and be replaced by a consumption tax based on the value-added concept known as Goods and Services Tax GST. GST is also charged on the importation of goods and services. There are separate rules for determining the place of supply for goods and for services.

What supplies are liable to the standard rate. GST does not need to be charged on out-of-scope supplies and such supplies need not be reported in the GST return. A taxable supply is a supply which is standard rated or zero rated.

The following aspects of the GST system should be noted for all companies registering for the new system. Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST. GST is a broad based consumption tax covering all sectors of the economy ie all goods and services made in Malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the Minister of Finance and published in the Gazette.

However the extent to which this may increase the price of goods remains to be seen and may be somewhat mitigated depending on the scope of tax exemptzero-rated goods. Out-of-scope supplies include sale of goods not brought into Singapore sales of overseas goods made within the Free Trade Zone and Zero GST Warehouses and private transactions. GST is levied and charged at a proposed rate of 6 percent on the value of supply.

From 01 June 2018 GST should be charged at standard rate of 0 on the difference between the total value of the supply and the value of the supply before 01 June 2018. From a location in Malaysia to another location in Malaysia or. Responsibilities of a GST-registered Business.

Supplies made outside of Malaysia are considered to be out of the scope of GST. Responsibilities of registered person. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

The businesses already registered with the GST dont need to. Jabatan Kastam Diraja Malaysia. No GST will be imposed on the supply made by the Federal Government and State Government such as healthcare services provided by hospital and.

The prescribed threshold is RM500000 of annual turnover. GST code Rate Description. Place of supply goods The place of supply of goods is in Malaysia if the supply involves goods which are removed.

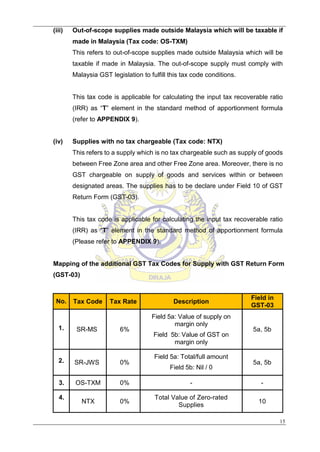

Tax Code Mapping to GST-03 Box 15. It has been reported that businesses in Malaysia have spent almost RM15 billion to implement GST systems that have been in use for less than four years8. However it may change from time to time.

Types of GST in Malaysia. HISTORY OF GST IN MALAYSIA. It is now refers to Total Value of Other Supplies that comprises of tax codes.

The current threshold is set at an amount of RM500000. OS OS-TXM GS NTX and SR-JWS. For purchases with input tax where the GST registered entity elects not to claim for it.

10 percent for Sales Tax and 6 percent for Service Tax. GST will be implemented from 1 April 2015. REGISTRATION FOR GST 17.

Malaysia Indirect Tax 15 May 2018 Indirect Tax Alert Abolition of the Malaysian GST How. What It Is and How It Works. E-Learning course Overview of GST.

Input tax on purchases made from GST registered suppliers by local authorities or statutory bodies to perform regulatory and enforcement functions. Invoicing Price Display and Record Keeping. Here is the a potential list of out of scope supplies to be disclosed.

GST shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person. GST shall be levied and charged on the taxable supply of goods and services. Here is A List of Potential Out of Scope Supplies.

The Royal Malaysian Customs Department RMCD has already commenced GST closure audits even arranging for tax professionals to conduct some audits for and on their behalf. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. The threshold for operators of restaurants cafes bars canteens or any food and beverage business is subject to RM 1500000.

Goods and Services Tax GST.

Countries Implementing Gst Or Vat

Gst Vs Sst Which Is Better Pressreader

Salient Features Of Gst Matta Date 28 April 2014 Place Vivatel Hotel Ppt Download

Salient Features Of Gst Matta Date 28 April 2014 Place Vivatel Hotel Ppt Download

Session Malaysias New Gst Business Change With Tax

Scope Of Goods Services Tax Gst Goods Services Tax Gst Malaysia Nbc Group

Uparrow Malaysian Gst Enhancement 1st Phase Implementation Home Gst Malaysian Gst Enhancement 1st Phase Implementation September 24 2014 Mohd Imran Gst No Comments Contents Hide 1 Introduction 2 Activating Gst Functions 3

Malaysian Royal Customs Department Guide On Gst Accounting Software

Gst Malaysia Gst Treatment Disbursement Reimbursement Facebook By Gst Malaysia